Welligence Concludes Beta Testing; Announces Launch Of Its Upstream Asset-Specific Greenhouse Gas Analytics Solution

October 5, 2021

HOUSTON, Oct. 5, 2021 – Welligence is thrilled to announce the release of our Greenhouse Gas Analytics solution, which incorporates granular asset-level emissions calculations into Welligence’s renowned financial and forecast models. The launch puts the market’s most practical and ideal analytical tool into the hands of our E&P clients, including business development, energy transition, commercial, technical, and planning teams. If you are not currently working with us, reach out to learn more – when it comes to calculating upstream emissions, Welligence’s market-leading detailed upstream approach has never been more important for you.

The overwhelming industry feedback points to a lack of a compelling solution that transparently calculates the emissions associated with upstream assets. Welligence has partnered with its clients and leveraged its industry-leading upstream data and analytics to provide practical and actionable insights that will assist the industry in addressing climate change by tracking net-zero targets. Features include:

1 . Integrated Modeling: Instantly analyze the economic and environmental impacts of different development strategies via our fully transparent emissions model, which is integrated into our cash flow models. Clients can quickly analyze the impact of different carbon mitigation efforts, carbon taxes, and more.

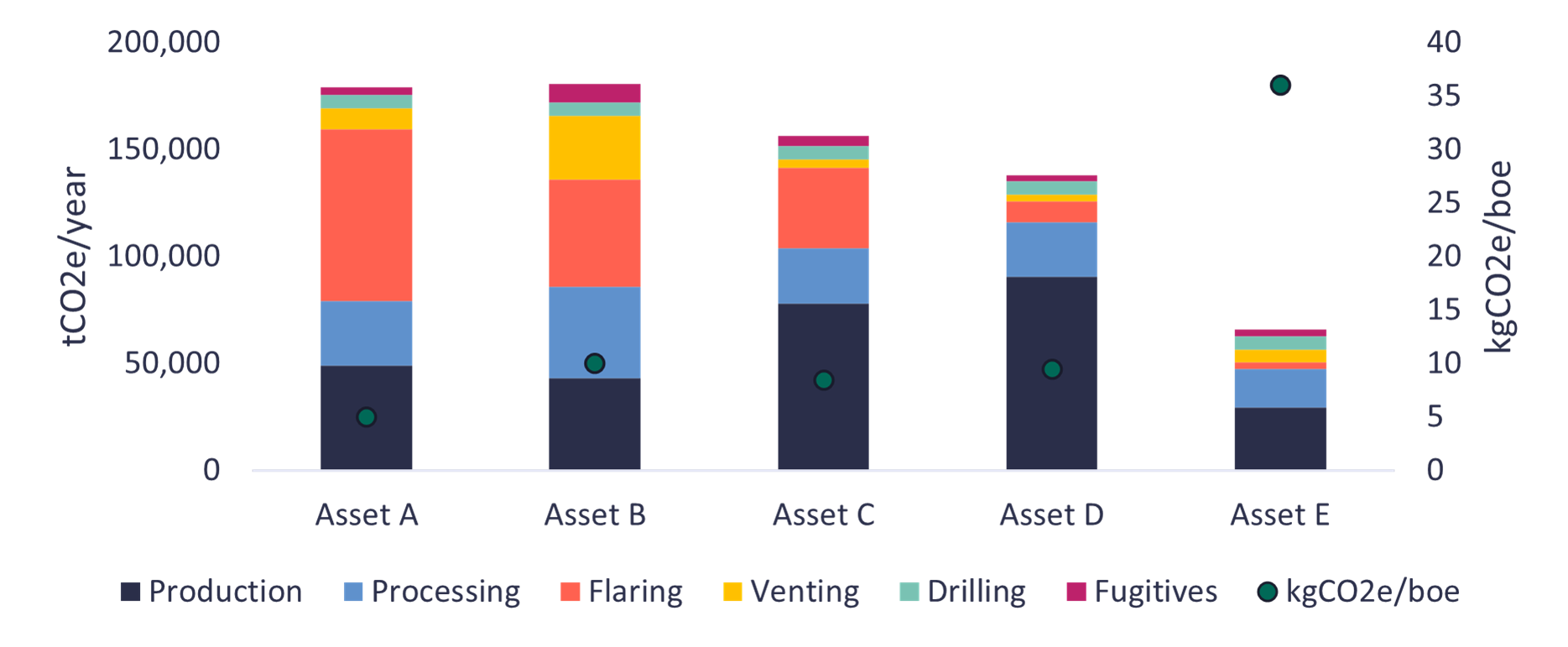

2. Benchmarking: Gain a better understanding of the current and future competitive value of your portfolio and that of your competitors via our Greenhouse Gas benchmarking platform. Compare your portfolio across numerous metrics and understand the key sources of your GHG emissions.

Welligence GHG Benchmarking Tool

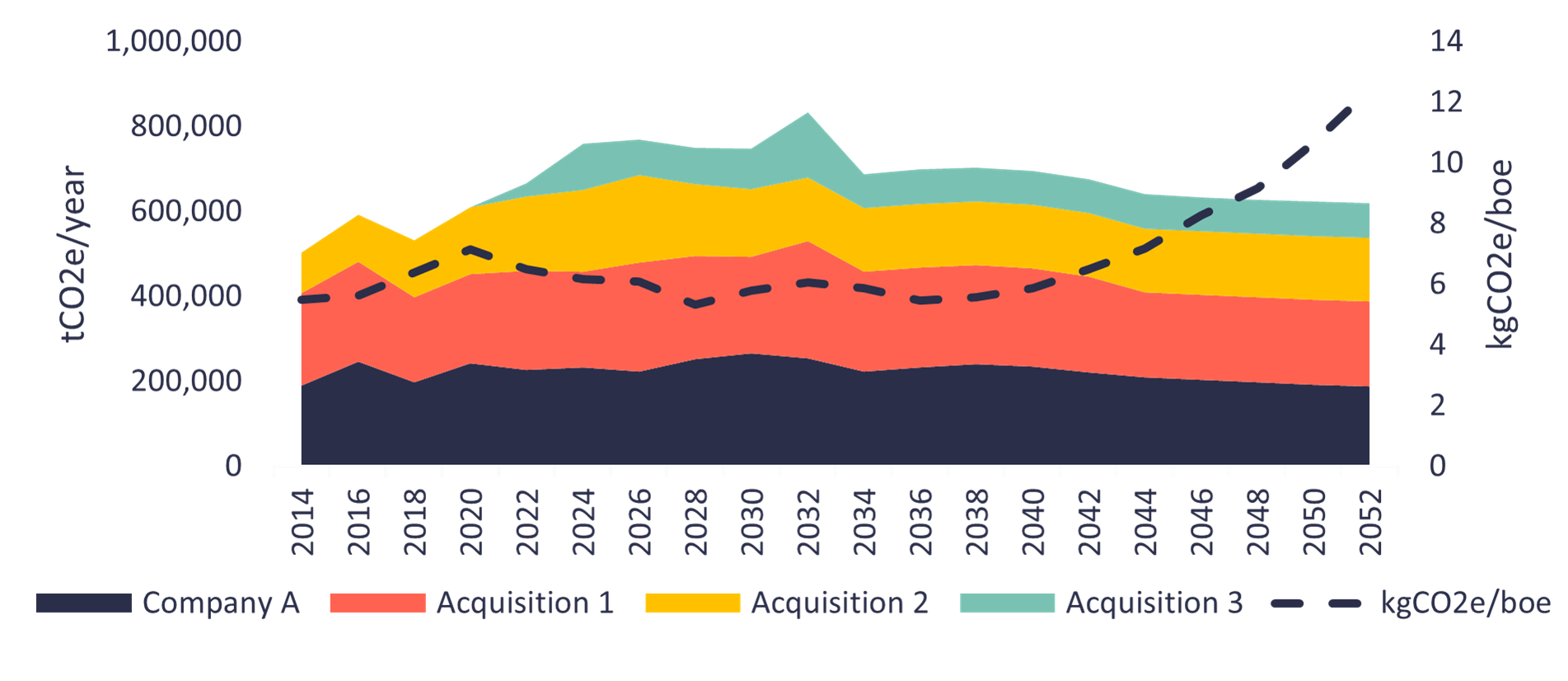

3. M&A Analysis: Optimize your portfolio by understanding the economic and environmental impacts of acquisitions and divestment via our Greenhouse Gas portfolio platform. Like the rest of our platform, Welligence’s Greenhouse Gas offering is fully transparent and fed with the latest asset-specific data and algorithms, giving you actionable forward-looking insight that you can trust and use to support upstream decision-making.

Welligence Greenhouse Gas Portfolio Emission

Welligence and its clients understand that emissions cannot be analyzed or addressed in isolation. A balanced and sustainable approach requires emissions metrics to be integrated into the broader operational strategy, and therefore into financial and operational models, forecasts, and strategic plans. This is why we built Greenhouse Gas Analytics directly into Welligence’s current solution.

The initial release is focused on the US Gulf of Mexico, with other countries to rapidly follow.

For more information about this product or to arrange a demo of the Greenhouse Gas Emissions Tool, please contact us at info@welligence.com.

About Welligence Energy Analytics

Welligence is a rapidly growing energy research firm that focuses on the upstream decarbonization space and asset-level commercial and technical research. The firm’s proprietary model combines expertise in upstream research, statistics and machine learning, engineering, investment banking, and private equity to create the market’s most powerful flow of upstream data and analysis to its clients. Coverage includes granular commercial valuations, information on assets on the market, a database covering thousands of assets, and greenhouse gas emissions, updated monthly by some of the most knowledgeable and responsive analysts in the industry.

To learn more, please visit www.welligence.com.